SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

BIO-RAD LABORATORIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notes:

BIO-RAD LABORATORIES, INC.

1000 Alfred Nobel Drive

Hercules, California 94547

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF

BIO-RAD LABORATORIES, INC.

TO BE HELD APRIL 29, 200327, 2004

TO THE STOCKHOLDERS OF BIO-RAD LABORATORIES, INC.:

The annual meeting of the stockholders of Bio-Rad Laboratories, Inc., a Delaware corporation (“Bio-Rad” or the “Company”), will be held at the Company’s corporate offices, 1000 Alfred Nobel Drive, Hercules, California 94547 on Tuesday, April 29, 200327, 2004 at 4:00 p.m., Pacific Daylight Time, to consider and vote on:

| (1) | The election of two directors of the Company by the holders of outstanding Class A Common Stock and five directors of the Company by the holders of outstanding Class B Common Stock; |

| (2) | A proposal to ratify the selection of Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ending December 31, |

| (3) | To approve an amendment to our certificate of incorporation to increase the authorized number of shares of capital stock from 77,500,000 to 107,500,000 shares by increasing the authorized number of shares of Class A |

| (4) | Such other matters as may properly come before the meeting and at any adjournments or postponements thereof. |

TheOur Board of Directors of the Company has fixed the close of business on March 4, 20031, 2004 as the record date for the determination of the stockholders entitled to notice of and to vote at this annual meeting and at any adjournments or postponements thereof. TheOur stock transfer books of the Company will not be closed.

All stockholders are invited to attend the annual meeting in person, but those who are unable to do so are urged to execute and return promptly the enclosed Proxyproxy in the provided postage-paid envelope. Since a majority of the outstanding shares of each class of our common stock of the Company must be present or represented at the annual meeting to elect directors and conduct the other business matters referred to above, your promptness in returning the enclosed Proxyproxy will be greatly appreciated. Your Proxyproxy is revocable and will not affect your right to vote in person in the event you attend the meeting and revoke your Proxy.proxy.

All stockholders who attend the annual meeting are invited to join the Companyus for a catered reception immediately following the meeting.

By order of the Board of Directors

BIO-RAD LABORATORIES, INC.

SANFORD S. WADLER, Secretary

Hercules, California

April 3, 2003March 31, 2004

BIO-RAD LABORATORIES, INC.

1000 Alfred Nobel Drive

Hercules, California 94547

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 29, 200327, 2004

Information Regarding Proxies

The enclosed Proxy is solicited on behalf of theOur Board of Directors of Bio-Rad Laboratories, Inc., a Delaware corporation (“Bio-Rad” oris soliciting the “Company”),enclosed proxy in connection with theour annual meeting of stockholders of the Company to be held at the Company’sour corporate offices, 1000 Alfred Nobel Drive, Hercules, California 94547 on Tuesday, April 29, 200327, 2004 at 4:00 p.m., Pacific Daylight Time, and at any adjournments or postponements thereof. Copies of this Proxy Statementproxy statement and the accompanying notice and Proxy Cardproxy card are first being mailed on or about April 3, 2003March 31, 2004 to all stockholders entitled to vote.

The CompanyWe will pay the cost of this Proxyproxy solicitation. In addition to solicitation by use of the mails, proxies may be solicited from our stockholders of the Company by our directors, officers and employees of the Company in person or by telephone, telegram or other means of communication. SuchThese directors, officers and employees will not be additionally compensated, but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. Arrangements will be made with brokerage houses, custodians, nominees and fiduciaries for forwarding of proxy materials to beneficial owners of shares held of record by such brokerage houses, custodians, nominees and fiduciaries and for reimbursement of their reasonable expenses incurred in connection therewith. The CompanyWe may retain Georgeson Shareholder Services, a proxy solicitation firm, to solicit proxies in connection with theour annual meeting, at an estimated cost of $6,000.00.

Shares for which a properly executed Proxyproxy in the enclosed form is returned will be voted at theour annual meeting in accordance with the directions on such Proxy.proxy. If no voting instructions are indicated with respect to one or more of the proposals, the Proxyproxy will be voted in favor of the proposal(s), and to approve those other matters that may properly come before the annual meeting at the discretion of the person named in the Proxy.proxy. Any Proxyproxy may be revoked by the record owner of the shares at any time prior to its exercise by filing with theour Secretary of the Company a written revocation or duly executed Proxyproxy bearing a later date or by attending the meeting in person and announcing such revocation. Attendance at the annual meeting will not, by itself, constitute revocation of a Proxy.proxy.

Voting Securities

TheOur securities of the Company entitled to vote at the meeting consist of shares of itsour Class A Common Stock and Class B Common Stock, both $0.0001 par value (collectively, “Common Stock”). 20,443,31420,800,252 shares of Class A Common Stock and 4,851,9424,850,140 shares of Class B Common Stock were issued and outstanding at the close of business on March 4, 2003. Only1, 2004.Only stockholders of record at the close of business on March 4, 20031, 2004 will be entitled to notice of and to vote at the meeting. The presence, in person or by Proxy,proxy, of the holders of a majority of theour Voting Power will constitute a quorum for the transaction of business, business;provided, however, that the election of the Class A and Class B directors shall require the presence, in person or by Proxy,proxy, of the holders of a majority of the outstanding shares of each respective class,. and the amendment of our certificate of incorporation to increase the authorized number of shares of capital stock shall require the presence, in person or by proxy, of the holders of a majority of the outstanding shares of Class A Common Stock and a majority of our Voting Power. Each share of Class A Common Stock is entitled to one-tenth of a vote and each share of Class B Common Stock is entitled to one vote, except in the election of directors and any other matter requiring the vote of one or both classes of Common Stock voting separately. The sum of one-tenth the number of outstanding shares of Class A Common Stock and the number of outstanding shares of Class B Common Stock constitutes theour “Voting Power” of the Company.Power.”

The holders of Class A Common Stock, voting as a separate class, are entitled to elect two directors. The holders of Class B Common Stock, also voting as a separate class, are entitled to elect the other five directors. The stockholders do not have any right to vote cumulatively in any election of directors. Under Delaware law, directors elected by each class shall be elected by a plurality of the votes in the respective class.

On all other matters submitted to a vote at the annual meeting (except matters requiring the vote of one or both classes voting separately), the affirmative vote of the holders of a majority of theour Voting Power present in person or represented by Proxyproxy is necessary for approval. The Board of Directors is not aware of any matters that might come before the meeting other than those mentioned in this Proxy Statement.proxy statement. If, however, any other matters properly come before the annual meeting, it is intended that the proxies will be voted in accordance with the judgment of the person or persons voting such proxies.

Under the Company’sour Bylaws and Delaware law: (1) shares represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee which are represented at the meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum; (2) with respect to the directors to be elected by each class of Common Stock, the director nominees receiving the highest number of votes, up to the number of directors to be elected by that class, are elected and, accordingly, abstentions, broker non-votes and withholding of authority to vote will not affect the election of directors; and (3) proxies that reflect abstentions as to a particular proposal will be treated as voted for purposes of determining the approval of that proposal and will have the same effect as a vote against that proposal, while proxies that reflect broker non-votes will be treated as unvoted for purposes of determining approval of that proposal and will not be counted as votes for or against that proposal.

There is no statutory or contractual right of appraisal or similar remedy available to those stockholders who dissent from any matter to be acted upon.

2

PRINCIPAL AND MANAGEMENT STOCKHOLDERS

The following table presents certain information as of March 4, 20031, 2004 (except as noted below), with respect to our Class A Common Stock and Class B Common Stock beneficially owned by: (i) any person who is known to the Companyus to be the beneficial owner of more than five percent of the outstanding Common Stock of either class, (ii) each director of Bio-Rad,our directors, (iii) certain of our executive officers of Bio-Rad named in the “Summary Compensation Table” of this Proxy Statement,proxy statement and (iv) all of our directors and executive officers of Bio-Rad as a group. The address for all executive officers and directors is c/o Bio-Rad Laboratories, Inc., 1000 Alfred Nobel Drive, Hercules, California, 94547.

Class A Common Stock(1) | Class B Common Stock | |||||||||

Name and, with Respect to Owner of 5% or More, Address | Number of Shares and Nature of Ownership(2) | Percent of Class | Number of Shares and Nature of Ownership(2) | Percent of Class | ||||||

Blue Raven Partners, L.P.(3) 1000 Alfred Nobel Drive Hercules, CA 94547 | — | 0.0 | % | 4,060,054 | 83.7 | % | ||||

Private Capital Management, Inc.(4) 8889 Pelican Bay Boulevard Suite 500 Naples, FL 34108 | 1,482,374 | 7.3 | % | — | 0.0 | % | ||||

Bernard A. Egan 1900 Old Dixie Highway Fort Pierce, FL 34946 | 1,351,963 | 6.6 | % | — | 0.0 | % | ||||

David and Alice N. Schwartz(5)(6)(9) Bio-Rad Laboratories, Inc. 1000 Alfred Nobel Drive Hercules, CA 94547 | 3,210,383 | 15.7 | % | 4,522,682 | 87.4 | % | ||||

Norman Schwartz(5)(7)(8)(9) Bio-Rad Laboratories, Inc 1000 Alfred Nobel Drive Hercules, CA 94547 | 211,454 | 1.0 | % | 4,098,098 | 84.1 | % | ||||

Steven Schwartz(5)(7)(10) Bio-Rad Laboratories, Inc. 1000 Alfred Nobel Drive Hercules, CA 94547 | 164,998 | 0.8 | % | 4,069,164 | 83.9 | % | ||||

James J. Bennett(9) | 83,058 | 0.4 | % | 47,454 | 1.0 | % | ||||

John Goetz(9) | 43,944 | 0.2 | % | — | 0.0 | % | ||||

Albert J. Hillman | 8,908 | 0.0 | % | 8,234 | 0.2 | % | ||||

Ruediger Naumann-Etienne | 2,500 | 0.0 | % | 100 | 0.0 | % | ||||

Philip L. Padou | — | 0.0 | % | — | 0.0 | % | ||||

Sanford S. Wadler(9) | 55,412 | 0.3 | % | — | 0.0 | % | ||||

All directors and executive officers as a group(9)(12 persons) | 3,626,425 | 17.7 | % | 4,616,514 | 88.9 | % | ||||

| Class A Common Stock(1) | Class B Common Stock | |||||||||

Name and, with Respect to Owner of 5% or More, Address | Number of Shares and Nature of Ownership(2) | Percent of Class | Number of Shares and Nature of Ownership(2) | Percent of Class | ||||||

Blue Raven Partners, L.P.(3) 1000 Alfred Nobel Drive Hercules, CA 94547 | — | 0.0 | % | 4,060,054 | 83.7 | % | ||||

Private Capital Management, Inc.(4) 8889 Pelican Bay Boulevard Suite 500 Naples, FL 34108 | 2,383,568 | 11.5 | % | — | 0.0 | % | ||||

Bernard A. Egan 1900 Old Dixie Highway Fort Pierce, FL 34946 | 1,347,963 | 6.5 | % | — | 0.0 | % | ||||

Nordea 1, SICAV(5) 672, rue de Neudorf Findel P.O. Box 782 L-2017, Luxembourg | 1,111,300 | 5.3 | % | — | 0.0 | % | ||||

David and Alice N. Schwartz(6)(7)(10) Bio-Rad Laboratories, Inc. 1000 Alfred Nobel Drive Hercules, CA 94547 | 3,209,623 | 15.4 | % | 4,569,736 | 87.8 | % | ||||

Norman Schwartz(6)(8)(9)(10) Bio-Rad Laboratories, Inc. 1000 Alfred Nobel Drive Hercules, CA 94547 | 211,454 | 1.0 | % | 4,121,428 | 84.4 | % | ||||

Steven Schwartz(6)(8)(11) Bio-Rad Laboratories, Inc. 1000 Alfred Nobel Drive Hercules, CA 94547 | 165,077 | 0.8 | % | 4,071,434 | 83.9 | % | ||||

James J. Bennett(10) | 51,316 | 0.2 | % | 47,454 | 1.0 | % | ||||

John Goetz(10) | 49,063 | 0.2 | % | — | 0.0 | % | ||||

Albert J. Hillman(10) | 8,908 | 0.0 | % | 8,234 | 0.2 | % | ||||

Ruediger Naumann-Etienne(10) | 3,000 | 0.0 | % | 200 | 0.0 | % | ||||

Philip L. Padou(10) | — | 0.0 | % | — | 0.0 | % | ||||

Sanford S. Wadler(10) | 51,833 | 0.2 | % | — | 0.0 | % | ||||

Christine A. Tsingos(10) | 2,000 | 0.0 | % | — | 0.0 | % | ||||

All directors and executive officers as a group(10)(12 persons) | 3,596,970 | 17.2 | % | 4,688,508 | 89.5 | % | ||||

| (1) | Excludes |

3

|

| (2) | Except as otherwise indicated and subject to applicable community property and similar statutes, the persons listed as beneficial owners of the shares have sole voting and investment power with respect to such shares. Number of shares is based on the statements of the stockholders where not identified specifically in the stockholder register. |

| (3) | David Schwartz, Alice N. Schwartz, Norman Schwartz and Steven Schwartz are general partners of Blue Raven Partners, L.P., a California limited partnership (the “Partnership”), and, as such, share voting and dispositive power over the Class B Common Stock held by the Partnership. |

| (4) | Based solely on a Form 13F filed on February 13, 2004 with the Securities and Exchange Commission pursuant to Rule 13f-1 of the Exchange Act. Includes 1,111,300 shares owned by Nordea 1, SICAV. |

| (5) | Based solely on an amended Schedule 13G filed on February |

| (6) | Includes 4,060,054 shares of Class B Common Stock held by the Partnership. |

| (7) | David and Alice N. Schwartz each have a one-half community property interest in these shares. |

| (8) | Norman Schwartz and Steven Schwartz are sons of David and Alice N. Schwartz. |

| (9) | Includes |

| (10) | Includes shares with respect to which such persons have the right to acquire beneficial ownership immediately or within sixty days of March |

| (11) | Includes |

4

I. ELECTION OF DIRECTORS

TheOur Board of Directors currently has seven members. The seven persons nominated are listed in the following table as the candidates nominated by management for the respective classclasses of Common Stock indicated. All are currently our directors of the Company with terms expiring as of the date of the annual meeting of stockholders or on election and qualification of their successors. David Schwartz and Alice N. Schwartz are husband and wife; Norman Schwartz is their son. No other family relationships exist among the Company’sour current and nominated directors or executive officers. As husband and wife, David and Alice N. Schwartz share equally in all remuneration and other benefits accorded to either of them by the Company.us.

The directors elected at this meeting will serve until the next annual meeting of stockholders or until their respective successors are elected and qualified. It is the intention of theThe persons named in the Proxyproxy intend to vote the shares subject to such Proxyproxy for the election as directors of the persons listed in the following table. Although it is not contemplated that any nominee will decline or be unable to serve as a director, in the event that at the meeting or any adjournments or postponements thereof any nominee declines or is unable to serve, the persons named in the enclosed Proxyproxy will, in their discretion, vote the shares subject to such Proxyproxy for another person selected by them for director.

Name | Class of Common Stock to Elect | Age | Present Principal Employment and Prior Business Experience | Director Since | Class of Common Stock to Elect | Age | Present Principal Employment and Prior Business Experience | Director Since | ||||||||

James J. Bennett | Class B | 74 | Retired from the Company as Chief Operating Officer and Executive Vice President effective January 1, 2003; Chief Operating Officer of the Company from 1993 through December 2002 and Executive Vice President of the Company from 1996 through December 2002; Vice President and Group Manager, Clinical Diagnostics of the Company from 1985 to 1993; Vice President and Chief Operating Officer of the Company from 1977 to 1985. | 1977 | Class B | 75 | Retired in 2002 as our Chief Operating Officer, in which capacity he served since 1993, and our Executive Vice President, in which capacity he served since 1996; our Vice President and Group Manager, Clinical Diagnostics from 1985 to 1993; our Vice President and Chief Operating Officer from 1977 to 1985. | 1977 | ||||||||

Albert J. Hillman | Class A | 71 | Of Counsel to the law firm of Townsend and Townsend and Crew since 1995 and partner in the firm from 1965 to 1995, which firm serves as patent counsel for the Company. | 1980 | Class A | 72 | Of Counsel to the law firm of Townsend and Townsend and Crew since 1995 and partner in the firm from 1965 to 1995, which firm serves as our patent counsel. | 1980 | ||||||||

Ruediger Naumann-Etienne | Class B | 56 | Owner and Managing Director of Intertec Group (an investment company specializing in the medical technology field) since 1989; Chairman and Chief Executive Officer of Quinton Cardiology Systems (a medical equipment company) since 2000; Director of Varian Medical Systems; Chairman of OEC Medical Systems from 1993 to 1999 and CEO from 1995 to 1997; President and Chief Operating Officer of Diasonics (a medical equipment manufacturer) from 1987 to 1990. | 2001 | Class B | 57 | Owner and Managing Director of Intertec Group since 1989; Chairman of Quinton Cardiology Systems since 2000 and Chief Executive Officer of Quinton Cardiology Systems from 2000 to 2003; Director of Varian Medical Systems since 2003; Chairman of OEC Medical Systems from 1993 to 1999, and Chief Executive Officer of OEC Medical Systems from 1995 to 1997; President and Chief Operating Officer of Diasonics from 1987 to 1990. | 2001 | ||||||||

Philip L. Padou | Class A | 68 | Retired since 1991; Vice President and Chief Financial Officer of Ozier Perry and Associates (a risk assessment software and consulting company) from 1987 to 1991. | 1980 | Class A | 69 | Retired since 1991; Vice President and Chief Financial Officer of Ozier Perry and Associates (a risk assessment software and consulting company) from 1987 to 1991. | 1980 | ||||||||

Alice N. Schwartz | Class B | 76 | Retired since 1979; Research Associate, University of California, from 1972 to 1978. | 1967 | Class B | 77 | Retired since 1979; Research Associate, University of California, from 1972 to 1978. | 1967 |

5

Name | Class of Common Stock to Elect | Age | Present Principal Employment and Prior Business Experience | Director Since | Class of Common Stock to Elect | Age | Present Principal Employment and Prior Business Experience | Director Since | ||||||||

David Schwartz | Class B | 79 | Chairman of the Board of the Company since 1957; President and Chief Executive Officer of the Company from 1957 through December 2002. | 1957 | Class B | 80 | Chairman of the Board since 1957. Previously our President and Chief Executive Officer from 1957 through 2002. | 1957 | ||||||||

Norman Schwartz | Class B | 53 | President and Chief Executive Officer of the Company effective January 1, 2003; Vice President of the Company from 1989 through December 2002; Group Manager, Life Science of the Company from 1997 through December 2002; Group Manager, Clinical Diagnostics of the Company from 1993 to 1997. | 1995 | Class B | 54 | Our President and Chief Executive Officer since January 1, 2003; our Vice President from 1989 to 2002; our Group Manager, Life Science, from 1997 to 2002; and our Group Manager, Clinical Diagnostics, from 1993 to 1997. | 1995 |

In January 1997, the Companywe entered into a non-competition and employment continuation agreement with James J. Bennett pursuant to which our management of the Companyhas agreed to nominate him as director for a period of three years following his resignation from his then present position ofas Executive Vice President and Chief Operating Officer, and Executive Vice President. Mr. Bennett resigned from this positionwhich resignation became effective on January 1, 2003. See “Executive Compensation and Other Information.“Compensation of Directors.”

In addition to James J. Bennett, David Schwartz and Norman Schwartz, the following persons were our executive officers of the Company during all or part of 2002:2003: Bradford J. Crutchfield, John Goetz, Ronald W. Hutton, Christine A. Tsingos and Sanford S. Wadler. Bradford J. Crutchfield (age 41) was appointed Vice President and Group Manager of the Life Science Group in 2003. Previously, he held various positions within Bio-Rad since joining us in 1985, including Managing Director, Bio-Rad Microscience, and Manager of our BioMaterials Division. John Goetz (age 53)54) was appointed Vice President and Group Manager of the Clinical Diagnostics Group in 2000. Previously, he held various positions within Bio-Rad since joining the Companyus in 1974 including Plant Engineer, Manufacturing Manager, Division Manager of QSD and Operations Manager of the Diagnostics Group. Ronald W. Hutton (age 45)46) has been our Treasurer of the Company since 1997. Previously, he was Director of Treasury at Kaiser Aluminum & Chemical Corporation from 1993 to 1997. Christine A. Tsingos (age 44)45) was appointed our Chief Financial Officer in December 2002.2002 and Vice President in 2003. Previously, she was the Chief Operating Officer and Chief Financial Officer at Attest Systems, Inc., a provider of information technology asset discovery and management tools, from August 2002 to November 2002. Prior to that, Ms. Tsingos was a consultant to Attest Systems, Inc. from October 2000 to July 2002. She currently is and has been a member of its board of directors since May 2001. She was the Chief Financial Officer at Tavolo, Inc., an online retailer of gourmet cookware and food, from November 1999 to September 2000, and she was Treasurer, and later Vice President and Treasurer, of Autodesk, Inc., a developer of design software, from May 1990 to November 1999. Sanford S. Wadler (age 56)57) has been our General Counsel and Secretary since 1989 and was appointed Vice President in 1996. The Company’sOur executive officers also serve in various management capacities with our wholly owned subsidiaries of Bio-Rad.subsidiaries.

The Board of Directors recommends that you vote FOR the above-named director nominees for the class or classes of Common Stock that you hold.

6

COMMITTEES OF THE BOARD OF DIRECTORS

TheOur Board of Directors of the Company has an Audit Committee and a Compensation Committee. TheOur Board of Directors has no nominating committee or other committees performing similar functions. During 2002, the2003, our Board of Directors held a total of 11nine meetings (including regularly scheduled and special meetings) and no director attended fewer than 75% of such meetings andor meetings of any committee on which such director served.

Currently, theAudit Committee

Our Audit Committee is composed of Albert J. Hillman, Ruediger Naumann-Etienne and PhillipPhilip L. Padou. All three committeeAudit Committee members are “independent” directors, as determined in accordance with the independence standards set forth in Rule 121(A)10A-3 under the Securities Exchange Act of 1934, as amended, and Section 121A of the American Stock Exchange’s regulations.Exchange Company Guide, and each is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. The purpose of our Audit Committee recommendsis to oversee our accounting and financial reporting processes and the Boardaudits of Directorsour financial statements. Our Audit Committee is directly responsible for the firm to be employed byappointment, compensation, retention and oversight of the Company as itswork of any independent auditorsauditor we engage, including resolution of any disagreements between our management and the independent auditor regarding financial reporting, and is primarily responsible for approving the services performed by the Company’s independent auditors and for reviewing and evaluating the Company’sour accounting policies and its system of internal accounting controls. TheIn addition, our Audit Committee reviews the scope of our independent auditor’s audit of our financial statements, reviews and discusses our audited financial statements with management, prepares the annual Audit Committee reports that are included in our proxy statements and annually reviews the Audit Committee’s performance and the Audit Committee Charter, among other responsibilities. Our Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from us for, any independent counsel, experts or advisors that the Audit Committee believes to be necessary or appropriate in order to enable it to carry out its duties. Our Audit Committee met fivefour times in the year 2002.2003. A more complete discussion is provided in the “Report of the Audit Committee of the Board of Directors” of this Proxy Statement.proxy statement, and the Audit Committee Charter that our Board of Directors has adopted, which is attached to this proxy statement asAnnex A.

TheCompensation Committee

Our Compensation Committee, consisting of two non-employee directors, Albert J. Hillman and Philip L. Padou, met twice in 2002. The2003. Our Compensation Committee reviews and approves the Company’sour executive compensation policies. A more complete discussion is provided in the “Report of the Compensation Committee of the Board of Directors” of this Proxy Statement.proxy statement.

Nominating Committee Functions

Our Board of Directors does not have a standing nominating committee or a committee performing similar functions. Our Board of Directors believes that it is appropriate for us not to have a standing nominating committee because we are controlled by the Schwartz family. Each member of our Board of Directors participates in the consideration of director nominees. Albert J. Hillman, Ruediger Naumann-Etienne and Philip L. Padou are all “independent” directors, as determined in accordance with the independence standards set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, and Section 121A of the American Stock Exchange Company Guide; James J. Bennett, David Schwartz, Alice N. Schwartz and Norman Schwartz are not. However, because we are controlled by the Schwartz family, we are a “controlled company” for purposes of the American Stock Exchange listing standards, and thus we are not required to have a standing nominating committee comprised solely of independent directors.

Our Board of Directors has not adopted a charter governing the director nomination process. However, it is the policy of our Board of Directors to consider stockholder nominations for candidates for membership on our Board of Directors that are properly submitted as set forth below under the caption “Communications with the

7

Board of Directors.” The stockholder must submit a detailed resume of the candidate together with a written explanation of the reasons why the stockholder believes that the candidate is qualified to serve on our Board of Directors. In addition, the stockholder must include the written consent of the candidate, provide any additional information about the candidate that is required to be included in a proxy statement pursuant to the rules and regulations of the Securities and Exchange Commission, and must also describe any arrangements or undertakings between the stockholder and the candidate regarding the nomination. In order to be considered for inclusion in next year’s proxy statement, any such nominations must be properly submitted by November 25, 2004.

The director qualifications our Board of Directors has developed to date focus on what our Board of Directors believes to be those competencies that are essential for effective service on our Board of Directors. These qualifications include technical, operational and/or economic knowledge of our business and industries; experience in operational, financial and/or administrative management; financial and risk management acumen and experience in or familiarity with international business, markets and cultures, technological trends and developments, and corporate securities and tax laws. While a candidate may not possess every one of these qualifications, his or her background should reflect many of these qualifications. In addition, a candidate should possess integrity and commitment according to the highest ethical standards; be consistently available and committed to attending meetings; be able to challenge and share ideas in a positive and constructively critical manner and be responsive to our needs and fit in with other Board members from a business culture perspective.

Our Board of Directors identifies director nominees by first evaluating the current members of our Board of Directors who are willing to continue in service. Current members with qualifications and skills that are consistent with our Board of Directors’ criteria for Board service are re-nominated. As to new candidates, our Board of Directors generally polls its members and members of our management for their recommendations. Our Board of Directors may also review the composition and qualification of the boards of our competitors, and may seek input from industry experts or analysts. Our Board of Directors reviews the qualifications, experience and background of the candidates. In making its determinations, our Board of Directors evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best perpetuate our success and represent stockholder interests through the exercise of sound judgment. Any recommendations properly submitted by stockholders will be processed and are subject to the same criteria as are any other candidates.

Each of the nominees included on the attached proxy card was recommended for inclusion by all of the other members of our Board of Directors.

Communications with the Board of Directors

Individuals can communicate with our Board of Directors by mailing a written communication to:

Bio-Rad Laboratories, Inc.

1000 Alfred Nobel Drive

Hercules, California 94547

Attention: Corporate Secretary

The Corporate Secretary will promptly forward all such communications to the Chairman of the Board.

Board of Directors’ Policy Regarding Board Members’ Attendance at Annual Meetings

Every member of our Board of Directors is expected to attend our annual meetings of stockholders in person, absent extraordinary circumstances such as a personal emergency. All seven of directors attended last year’s annual meeting of stockholders in person.

8

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

In 2002,2003, Townsend and Townsend and Crew, the patent law firm to which Albert J. Hillman is Of Counsel, rendered legal services to the Company. Theus. Our Board of Directors has relied upon the Company’sour General Counsel to determine that the services of Townsend and Townsend and Crew were provided on terms at least as fair to the Companyus as if they had been provided by a non-affiliate.TheOur General Counsel is responsible for the management of all of the Company’sour relationships with providers of legal services.

COMPENSATION OF DIRECTORS

Pursuant to the policy of theour Board of Directors, of Bio-Rad, directors who are not also our employees of Bio-Rad are paid a fee of $1,600 per month plus $100 for any meetings in excess of sixteen16 per year for serving as directors. Audit Committee members are paid an additional $625 per month.

The Company hasIn January 1997, we entered into ana non-competition and employment and non-competecontinuation agreement with James J. Bennett. See “Executive CompensationBennett, our then Executive Vice President and Other Information—OtherChief Operating Officer. Under the terms of this Agreement, Mr. Bennett agreed not to compete with us for two years after the end of his employment with us. Mr. Bennett resigned as our Executive Compensation.”Vice President and Chief Operating Officer effective January 1, 2003. Pursuant to the terms of this Agreement, our management has agreed to nominate him as director for a period of three years following his resignation. Mr. Bennett is continuing to serve as an employee and perform mutually agreed tasks for six weeks in each twelve-month period for up to five years from his resignation. Mr. Bennett is paid his weekly salary in effect at the time of his resignation for those six weeks, plus his annual Board fees, the total of which is paid in 26 equal installments over each twelve-month period. For mutually agreed assignments extending beyond the six weeks, his compensation will be at his weekly pay rate in effect at the time of his resignation. During this period of continued part-time employment with us, Mr. Bennett is permitted to exercise all vested stock options granted to him prior to his resignation. In addition, if Mr. Bennett retires and ceases part-time employment with us, he is entitled to exercise his stock options for a period of two years after such retirement.

79

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following Summary Compensation Table presents compensation paid or accrued by the Companyus for services rendered during 2003, 2002 and 2001 and 2000 by theour CEO and theour four other most highly compensated executive officers of the Companyin 2003 (collectively, the “Named Executive Officers”) whose total annual salary and bonus exceeded $100,000 in 2002..

SUMMARY COMPENSATION TABLE

Annual Compensation(1) | Long-Term Compensation(2) | |||||||||||||

Name and Principal Position | Year | Salary | Bonus | Shares Underlying Options | All Other Compensation(3) | |||||||||

David Schwartz | 2002 | $ | 531,495 | $ | 317,526 | 65,240 | $ | 931,014 | (4) | |||||

President, CEO and Chairman | 2001 | $ | 528,835 | $ | 271,882 | 0 | $ | 591,967 | (4) | |||||

2000 | $ | 525,314 | $ | 260,825 | 74,000 | $ | 594,567 | (4) | ||||||

James J. Bennett | 2002 | $ | 494,000 | $ | 311,220 | 15,000 | $ | 10,000 |

| |||||

Executive Vice President and | 2001 | $ | 494,000 | $ | 266,482 | 0 | $ | 8,500 |

| |||||

Chief Operating Officer | 2000 | $ | 473,889 | $ | 245,046 | 19,750 | $ | 8,500 |

| |||||

Norman Schwartz | 2002 | $ | 348,424 | $ | 166,175 | 10,000 | $ | 10,000 |

| |||||

Vice President and Group Manager | 2001 | $ | 316,252 | $ | 154,644 | 0 | $ | 8,500 |

| |||||

2000 | $ | 287,914 | $ | 94,625 | 12,500 | $ | 8,500 |

| ||||||

John Goetz | 2002 | $ | 321,338 | $ | 189,388 | 10,000 | $ | 10,000 |

| |||||

Vice President and Group Manager | 2001 | $ | 300,190 | $ | 137,256 | 0 | $ | 8,500 |

| |||||

2000 | $ | 251,756 | $ | 129,019 | 11,590 | $ | 8,500 |

| ||||||

Sanford S. Wadler | 2002 | $ | 295,532 | $ | 305,957 | 10,000 | $ | 10,000 |

| |||||

Vice President, General Counsel and | 2001 | $ | 295,218 |

| 0 | 0 | $ | 8,500 |

| |||||

Secretary | 2000 | $ | 315,512 | $ | 145,114 | 14,000 | $ | 8,500 |

| |||||

Annual Compensation(1) | Long-Term Compensation(2) | |||||||||||||

Name and Principal Position | Year | Salary | Bonus | Shares Underlying Options | All Other Compensation(3) | |||||||||

David Schwartz Chairman of the Board(4) | 2003 2002 2001 | $ $ $ | 509,440 531,495 528,835 | $ $ $ | 166,248 317,526 271,882 | 10,000 65,240 0 | $ $ $ | 20,370 931,014 591,967 | (5) (5) | |||||

Norman Schwartz President and Chief Executive Officer(6) | 2003 2002 2001 | $ $ $ | 455,414 348,424 316,252 | $ $ $ | 150,082 166,175 154,644 | 67,783 10,000 0 | $ $ $ | 10,000 10,000 8,500 | ||||||

John Goetz Vice President and Group Manager | 2003 2002 2001 | $ $ $ | 337,340 321,338 300,190 | $ $ $ | 137,968 189,388 137,256 | 10,000 10,000 0 | $ $ $ | 10,000 10,000 8,500 | ||||||

Sanford S. Wadler Vice President, General Counsel and Secretary | 2003 2002 2001 | $ $ $ | 306,892 295,532 295,218 | $ $ $ | 86,815 305,957 0 | 10,000 10,000 0 | $ $ $ | 10,000 10,000 8,500 | ||||||

Christine A. Tsingos Vice President and Chief Financial Officer | 2003 2002 2001 | $ $ $ | 285,000 21,923 — | $ $ $ | 84,104 50,000 — | 10,000 0 — | $ $ $ | 1,148 0 — | ||||||

| (1) | All other annual compensation amounts not included elsewhere in this proxy statement for each of the Named Executive Officers were less than the amounts required for separate reporting and are included in salary. The |

| (2) | There have been no restricted stock awards or payouts under long-term incentive plans during the fiscal years reflected on this |

| (3) |

| (4) | President, Chief Executive Officer and Chairman of the Board during 2001 and 2002 and continued as Chairman in 2003. |

| (5) | In addition to profit sharing plan contributions as described in number (3) above, |

| (6) | Chief Executive Officer since January 1, 2003 and Vice President and Group Manager during 2001 and 2002. |

810

OPTION GRANTS IN 20022003

The following table presents certain information regarding stock options granted to the Named Executive Officers in 2002.2003.

Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation of Option Term(2) | ||||||||||||||||||||||||||||||

Number of Securities Underlying Options Granted | % of Total Options Granted to Employees In 2002 | Exercise Price ($/Share) | Expiration Date | ||||||||||||||||||||||||||||

Assumed Appreciation of 5% | Assumed Appreciation of 10% | ||||||||||||||||||||||||||||||

| Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation of Option Term(2) | ||||||||||||||||||||||||||||||

Name | Number of Securities Underlying Options Granted(1) | % of Total Options | Exercise Price ($/Share) | Expiration Date | Assumed Appreciation of 5% | Assumed Appreciation of 10% | |||||||||||||||||||||||||

David Schwartz | 10,390 | 2.74 | % | 31.77 | 02/06/07 | $ | 52,809 | $ | 153,081 | 2,777 | .92 | % | $ | 39.60 | 02/05/08 | $ | 17,623 | $ | 51,037 | ||||||||||||

54,850 | 14.45 | % | 28.88 | 02/06/12 | $ | 996,212 | $ | 2,524,596 | 7,223 | 2.38 | % | $ | 36.00 | 02/05/13 | $ | 163,530 | $ | 414,417 | |||||||||||||

James J. Bennett | 15,000 | 3.95 | % | 28.61 | 02/06/12 | $ | 269,890 | $ | 683,955 | ||||||||||||||||||||||

Sanford S. Wadler | 10,000 | 2.64 | % | 28.61 | 02/06/12 | $ | 179,927 | $ | 455,969 | 10,000 | 3.30 | % | $ | 35.50 | 02/05/13 | $ | 223,258 | $ | 565,779 | ||||||||||||

Norman Schwartz | 7,928 | 2.09 | % | 31.77 | 02/06/07 | $ | 40,295 | $ | 116,807 | 2,955 64,828 | .98 21.40 | % % | $ $ | 39.60 36.00 | 02/05/08 02/05/13 | $ $ | 18,753 1,467,719 | $ $ | 54,308 3,719,489 | ||||||||||||

2,072 | .55 | % | 28.88 | 02/06/12 | $ | 36,721 | $ | 93,917 | |||||||||||||||||||||||

John Goetz | 10,000 | 3.30 | % | $ | 35.50 | 02/05/13 | $ | 223,258 | $ | 565,779 | |||||||||||||||||||||

John Goetz | 10,000 | 2.64 | % | 28.61 | 02/06/12 | $ | 179,927 | $ | 455,969 | ||||||||||||||||||||||

Christine A. Tsingos | 10,000 | 3.30 | % | $ | 35.50 | 02/05/13 | $ | 223,258 | $ | 565,779 | |||||||||||||||||||||

| (1) | All stock options granted in |

| (2) | Potential realizable value is based on an assumption that the stock price of the applicable class of Common Stock appreciates at the annual rate shown (compounded annually) from the date of grant until the end of the |

911

The following table presents the number of shares for which options were exercised in 2002,2003, as well as the number of exercisable and unexercisable options held by the Named Executive Officers at December 31, 2002.2003.

AGGREGATE OPTION EXERCISES IN 20022003 AND

DECEMBER 31, 20022003 OPTION VALUES

Number of Securities Underlying Unexercised Options at December 31, 2002 | Value of Unexercised In-The-Money Options at December 31, 2002(1) | Number of Securities | Value of Unexercised In-The- | |||||||||||||||||||||||||||

Name | Shares Acquired on Exercise | Value Realized | Exercisable | Unexercisable | Exercisable | Unexercisable | Shares Acquired on Exercise | Value Realized | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||||||||

David Schwartz | 70,888 | $ | 1,298,108 | 268,536 | 158,490 | $ | 7,058,612 | $ | 3,230,947 | |||||||||||||||||||||

James J. Bennett | 44,616 | $ | 1,357,442 | 6,250 | 38,498 | $ | 174,688 | $ | 802,869 | |||||||||||||||||||||

David Schwartz(2) | 9,500 | $ | 261,725 | 328,453 | 99,073 | $ | 14,643,624 | $ | 3,402,483 | |||||||||||||||||||||

Sanford S. Wadler | 6,700 | $ | 160,072 | 29,800 | 25,500 | $ | 813,580 | $ | 530,715 | 600 | $ | 13,236 | 39,086 | 25,614 | $ | 1,790,352 | $ | 798,083 | ||||||||||||

Norman Schwartz | 7,500 | $ | 80,175 | 23,094 | 26,906 | $ | 617,390 | $ | 532,562 | |||||||||||||||||||||

Norman Schwartz(2) | 7,500 | $ | 162,600 | 25,598 | 84,685 | $ | 1,165,205 | $ | 2,073,634 | |||||||||||||||||||||

John Goetz | 3,600 | $ | 124,236 | 24,342 | 22,838 | $ | 653,974 | $ | 457,468 | 0 | $ | 0 | 33,185 | 23,995 | $ | 1,497,961 | $ | 730,186 | ||||||||||||

Christine A. Tsingos | 0 | $ | 0 | 0 | 10,000 | 0 | $ | 221,700 | ||||||||||||||||||||||

| (1) | The closing prices of Class A Common Stock and Class B Common Stock |

Other Executive Compensation

| (2) | David Schwartz and Norman Schwartz held options to purchase shares of Class B Common Stock only. |

In January 1997, the Company entered into a non-competition and employment continuation agreement with James J. Bennett, its then Executive Vice President and Chief Operating Officer and a Director of the Company. Mr. Bennett retired from his position as Executive Vice President and Chief Operating Officer effective January 1, 2003. Under the terms of this Agreement, Mr. Bennett has agreed not to compete with the Company for two years after the end of his employment with Bio-Rad. Management has agreed to nominate him as director for a period of three years following his resignation. Following his resignation, Mr. Bennett has agreed to continue to serve as an employee and perform mutually agreed tasks for six weeks in each twelve-month period for up to five years from his resignation. For those six weeks, he will be paid his weekly salary in effect at the time of his resignation plus $2,500 per week. For mutually agreed assignments extending beyond the six weeks, or if Mr. Bennett does not remain a director, his compensation would be at his weekly pay rate in effect at the time of his resignation. He will be entitled to exercise his stock options for a period of four years after the end of his employment with Bio-Rad.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

TheOur Compensation Committee is composed of Albert J. Hillman and Philip L. Padou. The CompanyWe do not currently has nohave any interlocking relationships with another entity involving any of itsour Compensation Committee members, and no executive officer of the Company serves on the Compensation Committee.members. James J. Bennett, David Schwartz, and Norman Schwartz, Alice N. Schwartz and Ruediger Naumann-Etienne participate in general Board of Directors’ discussions of compensation, bonuses and stock options. David, Norman and Alice N. Schwartz were absent from and did not participate in the discussions or decisions concerning theour President’s compensation.

10

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

TheOur Compensation Committee was formed in December 1993. The function of theour Compensation Committee is to review and approve the compensation arrangements for the Company’sour senior management and any compensation plans in which theour executive officers and directors are eligible to participate. TheOur Compensation Committee of the Board of Directors has furnished the following report on executive compensation.

Objectives and Overview

The overall objectives of the Company’sour executive compensation programs are:

12

Executive compensation consists of four components: 1)(1) base salary; 2)(2) annual and special incentive bonus payments; 3)(3) long-term incentives in the form of stock options;options and 4)(4) contributions to the Company’sour profit sharing plan. The Company strivesWe strive to provide a competitive total compensation package to our senior management based on professionally compiled surveys of broad groups of companies of comparable size within related industries.

Base Salary

Each year, the Company obtainswe obtain studies of compensation trends, practices and levels from a variety of nationally recognized independent compensation surveys in order to determine the competitiveness of the pay structure for itsour senior managers. Within the comparative groups of companies surveyed, the Company setswe set executive base salaries and total compensation near and below the arithmetic mean of the surveys, respectively. Each executive’s base salary is determined by an assessment of the executive’s job description and current salary in relation to the salary range designated for the position in the compensation surveys. Adjustments are made when necessary to reflect changes in responsibilities or competitive industry pressures. Each executive’s performance is evaluated annually to determine individual merit increases within the overall guidelines established in each year’s budget process. For 2002, the Company2003, our merit increase guideline was 4.25%3.75% and was based on the compensation surveys.

Incentive Bonus Payments

ExecutiveOur executive officers, of the Company, including the President, are eligible for an annual incentive bonus and special bonuses, determined as a percentage of the officers’ eligible wages. Annual bonuses are awarded to executive officers, including the President and our other key employees of the Company and itsour operating units, who meet certain annual Company and operating unit goals, which are previously established by our senior management. In 2002,2003, the performance factors used in calculating bonuses included sales volume, direct contribution and inventory and/or receivable management turns, as measured against annual objectives. Performance goals have been established for the Companyus as a whole and for each operating unit. Bonuses are determined using these performance factors and comparisons to competitive industry standards. The bonus calculation is weighted between Companyour performance and operating unit performance according to the responsibilities of each executive. Incentive bonuses may be awarded in cash and/or stock.

Bonuses for performance in 2003 were awarded in March 2004 and ranged from 0.0% to 40.9% of base salaries. Bonuses for 2002 were awarded in March 2003 and ranged from 2.8% to 104.0% of base salaries. Bonuses for 2001 were awarded in March 2002 and ranged from 0.0% to 53.9% of base salaries.

11

Bonuses for 2000 were awarded in March 2001 and ranged from 0.9% to 51.8% of base salaries. Because bonuses are based on growth and profitability, trends in bonus awards generally track operating unit and Companyour performance. Special bonuses are awarded only on completion of specific projects or transactions.

Long-Term Incentives

The Company provides itsWe provide our executive officers and other key employees with long-term incentive compensation through the grant of stock options. The Company believesWe believe that stock options provide the Company’sour key employees with the opportunity to purchase and maintain an equity interest in the Companyus and to share in the appreciation of the value of theour stock. Stock options are intended to align executive interests with the interests of stockholders and therefore directly motivate senior management to maximize long-term stockholder value. The stock options also create an incentive to remain with the Companyus for the long term because the options vestare vested over a fourfour- or five-year period. Because all options are granted at no less than the fair market value of the underlying stock on the date of grant, stock options provide value to the recipients only when the price of Bio-Radour Common Stock increases over time.

TheOur Board of Directors has delegated certain responsibilities of administration of the Company’sour stock option plans to the Stock Option Award Committee. TheOur Stock Option Award Committee is composed of Albert J. Hillman and Philip L. Padou and is responsible for determining the timing and distribution of grants subject to the terms of the current option plans. TheOur Stock Option Award Committee also determines the total number of shares granted and the allocation of shares to individual executive officers and key employees. Recommendations from senior

13

management and other factors are considered including: the responsibility level, individual performance and contribution to the Company’s business of each officer and key employee. The option grants are submitted to the Board of Directors for ratification and the date of grant is the date of the Board of Directors meeting.

Profit Sharing Plan Contributions

The Company’sOur employees who are directors or officers are entitled to participate in the Bio-Rad Laboratories, Inc. Employees’ Deferred Profit Sharing Retirement Plan (“Profit Sharing Plan”) on the same basis as all of our other Company employees. The Profit Sharing Plan covers all of our full-time employees, of the Company, or any of itsour participating subsidiaries, who have completed one year of service. Contributions to the Profit Sharing Plan are determined each year by theour Board of Directors in its sole discretion and are allocated among each participant based on the ratio his or her compensation bears to the aggregate compensation of all participants. For 2002, the2003, our Board of Directors approved a contribution of 5% of eligible compensation. Participants are vested 100% after five years of service, but funds are not distributed until retirement, termination of employment with the Companyus or as required by regulation or law.

Split Dollar Life Insurance

We were a party to a Split Dollar Life Insurance agreement with a trust established by David Schwartz and Alice N. Schwartz for their heirs. Our Board of Directors had determined that in the event of the demise of David Schwartz and Alice N. Schwartz, their heirs might be required to sell a significant amount of their holdings in us in order to satisfy estate taxes. Our Board of Directors believed that such event might have resulted in a major disruption in the trading of our stock, and determined that it was in the best interest of our stockholders to procure a life insurance policy that would provide proceeds to the heirs for the payment of such taxes. Under this agreement, the trust was the beneficiary of a life insurance policy insuring the lives of David Schwartz and Alice N. Schwartz. We paid the premiums for this policy, a portion of which would have been repaid to us upon the deaths of David Schwartz and Alice N. Schwartz prior to the termination of the agreement. This agreement and policy were terminated as of December 31, 2003.

President’s Compensation

For 2002, the2003, our Compensation Committee was primarily responsible for determining and approving theour President’s compensation. TheOur President’s compensation was compared with compensation of other CEOs in the above-mentioned surveys and proxy statements for comparable companies. David Schwartz’sOur President’s salary is typically set within the mid-range of CEO’s salaries surveyed for comparable companies. There was no change to Mr. Schwartz’s salary in 2000, 2001 or 2002.

TheOur President’s annual bonus is based on the achievement of the Company’sour financial goals. The same performance criteria are used to calculate hisour President’s annual bonus as those established for other eligible executive officers. These criteria are discussed above under Incentive“Incentive Bonus Payments.” A bonus of $150,082 was paid in 20032004 based on performance against previously established growth and profitability targets for 2002.2003.

12

In addition,Corporate Tax Deduction for Compensation in 2002, Mr. Schwartz received “split dollar” life insurance benefits from the Company. The BoardExcess of Directors of the Company has determined that in the event of the demise of David Schwartz and Alice Schwartz, their heirs might be required to sell a significant amount of their holdings in the Company in order to satisfy estate taxes. As the Board believes that such event might result in a major disruption in the trading of the stock, it has determined that it is in the best interest of all shareholders to procure a life insurance policy that would provide proceeds to the heirs for the payment of such taxes. The Company is a party to a “split dollar” life insurance agreement with a trust established by David Schwartz and Alice Schwartz for their heirs under which the trust is the beneficiary of a life insurance policy insuring the lives of David Schwartz and Alice Schwartz for which the Company pays the premiums. Upon the death of each of David Schwartz and Alice Schwartz prior to the termination of the agreement, a portion of the premiums previously advanced by the Company under the insurance policy will be repaid to the Company. Included in the compensation amounts shown for David Schwartz in fiscal year 2002 is $933,814, representing the premium payment by the Company in such year.$1 Million Per Year

To the extent readily determinable and as one of the factors in its consideration of compensation matters, theour Compensation Committee considers the anticipated tax consequences to the Companyus and to itsour executives of various payments and benefits. Some types of compensation payments and their deductibility (e.g., the spread on exercise of non-qualified options) depend upon the timing of an executive’s vesting or exercise of previously granted rights. Further, interpretations of and changes in the tax laws and other factors beyond theour Compensation Committee’s control also affect the deductibility of compensation. For these and other reasons, theour Compensation Committee will not necessarily limit executive compensation to that deductible under Section 162(m) of the Internal Revenue Code. TheOur Compensation Committee will consider various alternatives to

14

preserving the deductibility of compensation payments and benefits to the extent reasonably practicable and to the extent consistent with its other compensation objectives.

THE COMPENSATION COMMITTEE

Albert J. Hillman

Philip L. Padou

The Compensation Committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or the Exchange Act, and shall not otherwise be deemed filed under these actsActs.

1315

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Our audit committeeAudit Committee was established on September 24, 1992, and our Board of Directors adopted its audit committeeAudit Committee charter on June 7, 2000. During fiscal 2002,2003, the audit committee of the Board of DirectorsAudit Committee was comprised of Albert J. Hillman, Ruediger Naumann-Etienne and Philip L. Padou who were “independent” directors, as determined in accordance with the independence standards set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, and Section 121(A)121A of the American Stock Exchange’s regulations.Exchange Company Guide. Albert J. Hillman and Ruediger Naumann-Etienne joined the Audit Committee in October 2001; Philip L. Padou joined the Audit Committee in September 1992.

ManagementOur management is responsible for the Company’sour internal controls and theour financial reporting process. TheOur independent accountants are responsible for performing an independent audit of the Company’sour consolidated financial statements in accordance with auditing standards generally accepted in the United States of Americaaccounting practices and to issue a report thereon. TheOur Audit Committee’s responsibility is to monitor and oversee these processes. The following is theour Audit Committee’s report submitted to the Board of Directors for the fiscal year ended December 31, 2002.2003.

TheOur Audit Committee has:

| · | reviewed and discussed |

| · | discussed with Deloitte & Touche LLP, |

| · | discussed with Deloitte & Touche LLP, our independent auditors, its independence as required by Independence Standards Board Standard No. 1, as may be modified or supplemented. |

Based on the review and discussions referred to above, theour Audit Committee recommended to theour Board of Directors that the audited consolidated financial statements be included in the Company’sour Annual Report on Form 10-K for the fiscal year ended December 31, 20022003 for filing with the Securities and Exchange Commission.

Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees: The aggregate fees billed for professional services rendered by the Company’sour current independent auditors, Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte & Touche”) in connection with theirfor the audit of the Company’sour annual consolidated financial statements (including all of our subsidiaries), audit-related fees, tax fees and all other fees for the fiscal yearyears ended December 31, 2002 and 2003, as compiled on an invoice-date basis were:

| 2002 | 2003 | |||||

Audit Fees(1) | $ | 348,000 | $ | 1,503,800 | ||

Audit-Related Fees(2) | $ | 0 | $ | 348,300 | ||

Tax Fees(3) | $ | 95,300 | $ | 1,317,100 | ||

All Other Fees(4) | $ | 19,500 | $ | 0 | ||

| (1) | Audit Fees include aggregate fees billed for professional services rendered in connection with Deloitte & Touche’s audit of our annual consolidated financial statements for the fiscal years ended 2002 and 2003, the reviews of our consolidated financial statements included in our Quarterly Reports on Forms 10-Q for each of those fiscal years, and the attestation services for the statutory audits of international subsidiaries. Included in Audit Fees billed in 2003 is approximately $644,000 for services related to the audit of our consolidated financial statements for the fiscal year ended 2002. |

| (2) | Audit-Related Fees in 2003 include $201,100 for professional services rendered in connection with our offering of 7.50% Senior Subordinated Notes and $147,200 for services provided in connection with our readiness for compliance with the Sarbanes-Oxley Act of 2002. |

| (3) | Tax Fees include aggregate fees billed for professional services rendered in connection with tax planning, international tax compliance and expatriate income taxes. |

16

| (4) | Other Fees in 2002 include aggregate fees billed for professional services rendered in connection with our software system supporting the data underlying our financial statements, or generating information that is significant to such statements, taken as a whole. Such services were performed by Deloitte & Touche prior to their retention as our independent auditors. |

The Audit Committee pre-approves each and every service performed by our independent auditors, including all services described in each of the consolidated financial statements included in the Company’s Quarterly Reports on Forms 10-Q for that fiscal year were approximately $800,000.four subcategories above.

Financial Information Systems Design and Implementation Fees: The aggregate fees billed for services rendered by Deloitte & Touche forFor the fiscal year ended December 31, 2002, and2003, we paid by the Companyno fees to itsour principal accountants for professional services rendered in connection with consultation related to the Company’soperation, supervision or management of our information systems or local area network, or for the design or implementation of a hardware or software system supporting thefor aggregating source data underlying the Company’sour financial statements, or generating information that is significant to such statements, taken as a whole,whole. For the fiscal year ended 2002, we paid $19,500 for such services, which were approximately $19,500. These services were performed prior to the retention of Deloitte & Touche as the Company’s independent auditors.

All Other Fees: The aggregate fees billed for services rendered by Deloitte & Touche other than described above, for the fiscal year ended December 31, 2002 were approximately $423,300 and can be subcategorizedprior to their retention as the aggregate fees for attestation services for the statutory audits of international subsidiaries’ fiscal year 2002 financial statements (approximately $328,000) and tax planning and international tax compliance (approximately $95,300).our independent auditors.

The Company’s audit committee has considered whether the provision of services described above under the captions “Audit Fees” and “Financial Information Systems Design and Implementation Fees” are compatible with maintaining the principal accountant’s independence, and has determined that the provision of such services to the Company does not compromise the principal accountant’s independence.

14

Change of Independent Public Accountants in 2002: On July 8, 2002, the Company’sour Board of Directors adopted the recommendation of its audit committeeAudit Committee that Arthur Andersen LLP be dismissed as the Company’sour independent auditors and that Deloitte & Touche LLP be retained as the Company’sour new independent auditors. Andersen’s reports on the Company’sour financial statements for each of the yearsyear ended December 31, 2001 and 2000 did not contain an adverse opinion or disclaimer of opinion, nor were the reports qualified as to uncertainty, audit scope or accounting principles. During the yearsyear ended December 31, 2000 and 2001 and through July 8, 2002 there were no disagreements with Andersen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to Andersen’s satisfaction, would have caused Andersen to make reference to the subject matter in connection with its report on the Company’sour consolidated statements for such years; and there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

Our Audit Committee has considered whether the provision of services described above under the captions “Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees” and “Financial Information Systems Design and Implementation Fees” are compatible with maintaining our independent auditor’s independence, and has determined that the provision of such services to us does not compromise the independent auditor’s independence.

THE AUDIT COMMITTEE

Albert J. Hillman

Ruediger Naumann-Etienne

Philip L. Padou

The Audit Committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or the Exchange Act, and shall not otherwise be deemed filed under these acts.Acts.

1517

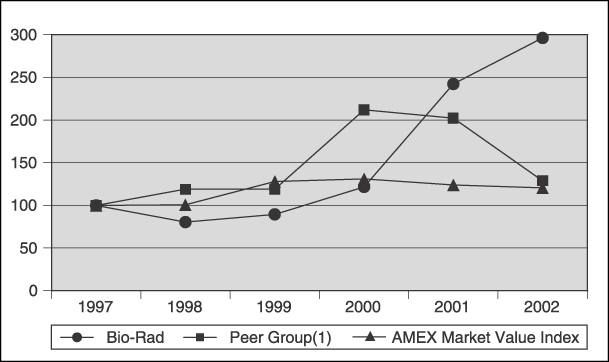

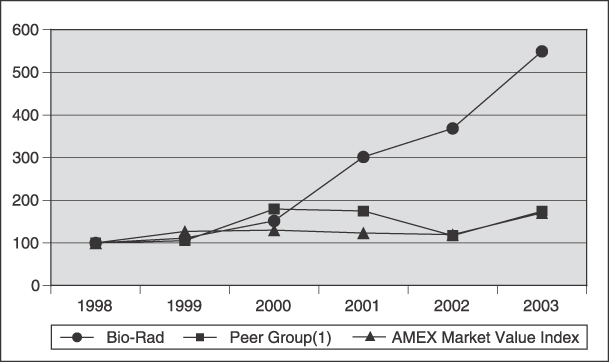

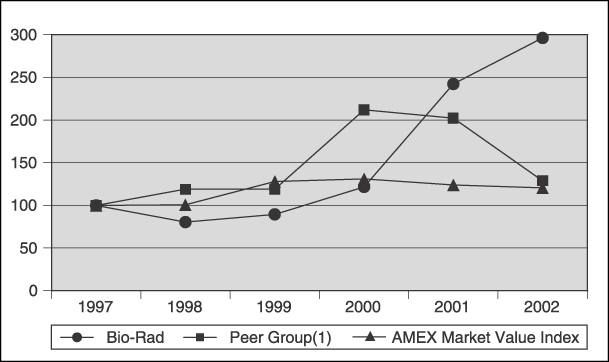

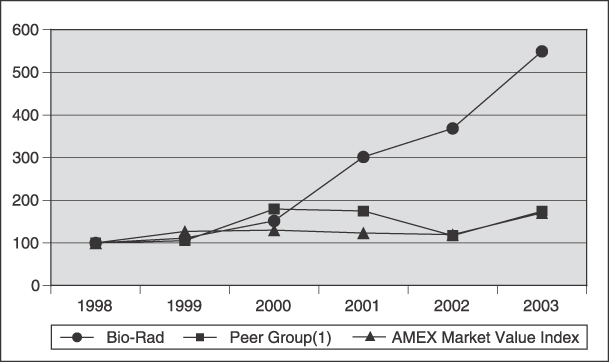

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative stockholder returns over the past five years for the Company’s Class A Common Stock, the American Stock Exchange Market Value Index and a selected peer group, assuming $100 invested on December 31, 1997,1998, and reinvestment of dividends:

| (1) | The peer group consists of the following public companies: Beckman Coulter; Becton Dickinson; Diagnostic Products; Invitrogen; Meridian Bioscience; Millipore; and PerkinElmer Inc. (note: Invitrogen |

This stock performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or the Exchange Act, and shall not otherwise be deemed filed under these acts.Acts.

1618

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’sour directors and executive officers, and persons who own more than ten percent of a registered class of the Company’sour equity securities, (“Insiders”), to file with the Securities and Exchange Commission (the “SEC”) initial reports of ownership and reports of changes in ownership of our Common Stock of the Company.Stock. Insiders are required by SECSecurities and Exchange Commission regulations to furnish the Companyus with copies of all Section 16(a) reports which they file.

To the Company’sour knowledge, based solely upon itsour review of the copies of such reports furnished to the Companyus and written representations from certain Insidersinsiders that no other reports were required, during the fiscal year ended December 31, 20022003, all Section 16(a) filing requirements applicable to Insidersinsiders were complied with, with the following exceptions: (i)in June 2003, a Form 4 filingwas submitted for James J. BennettNorman Schwartz indicating a gifting of 1,600 shares of Class B Common Stock received by his wife, Adria Schwartz, in January 2001, which was delayed; (ii) the Form 5 filing for 2002 for John Goetz was delayed; and (iii) the Form 3 filing for Bradford Crutchfield was delayed.not previously recorded.

II. RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

TheOur Board of Directors has selected Deloitte and& Touche LLP, independent public accountants, to serve as Bio-Rad’sour auditors for the fiscal year ending December 31, 2003.2004. A representative of Deloitte and& Touche LLP is expected to be present at the annual meeting of stockholders to make a statement if he or she desires to do so and to respond to appropriate questions.

Although it iswe are not required to do so, Bio-Rad wisheswe wish to provide our stockholders with the opportunity to express their opinion on the selection of auditors, and accordingly iswe are submitting a proposal to ratify the selection of Deloitte and& Touche LLP. If theour stockholders should fail to ratify this proposal, theour Board of Directors will consider the selection of another auditing firm.

The Board of Directors recommends that you vote FOR ratification of Deloitte and& Touche LLP to serve as the Company’sour independent auditors for the fiscal year ending December 31, 2003.2004.

III. APPROVAL OF THE 2003 STOCK OPTION PLANAMENDMENT TO INCREASE

AUTHORIZED NUMBER OF BIO-RAD LABORATORIES, INC.SHARES OF OUR CAPITAL STOCK

The 2003 Stock Option Plan of Bio-Rad Laboratories, Inc. (the “Plan”) was adopted by theOur Board of Directors on March 19, 2003.proposes to amend our restated certificate of incorporation to increase the number of authorized shares of our capital stock. Our stockholders are being askedexisting restated certificate of incorporation authorizes us to approve the Plan, copiesissue 77,500,000 shares of capital stock, of which will be available at the annual meeting of stockholders and may also be obtained by making written request of our corporate Secretary.

Set forth below is a description of the essential features of the Plan which will be in effect if the Plan is approved by the stockholders. This information does not purport to be a complete description of all the provisions of the Plan and is qualified in its entirety by reference to the provisions of the Plan.

Description of the Plan

General

The Plan authorizes the grant to employees of incentive stock options and non-qualified stock options. Incentive stock options50,000,000 shares are intended to be “incentive stock options,”designated as that term is defined in Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”). The purposes of the Plan are to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to employees and to promote the success of our business.

17

Options Granted and Share Reserve

A total of 1,675,000 shares have been reserved for issuance pursuant to the Plan. Shares that may be issued pursuant to the Plan are shares of either Class A orCommon Stock, 20,000,000 shares are designated as Class B Common Stock and 7,500,000 shares are designated as Preferred Stock. Our Board of Directors believes this capital structure is inadequate for our present and future needs. Therefore, on February 4, 2004, our Board of Directors unanimously adopted and declared advisable the amendment of our existing restated certificate of incorporation to increase the total number of our authorized shares of capital stock to 107,500,000 shares, of which 80,000,000 shares will be designated as Class A Common Stock, 20,000,000 shares will be designated Class B Common Stock and 7,500,000 shares will be designated Preferred Stock. Our Board of Directors believes this capital structure more appropriately reflects our present and future needs and recommends such amendment and restatement to our stockholders for adoption.

Shares subject to expired or canceled options willOur Board of Directors recommends that the our existing restated certificate of incorporation be available for future grant or sale underso amended by deleting and replacing Section 4(a) of our existing restated certificate of incorporation with the Plan. No shares may be optioned, granted or awarded under the Plan, however, if such action would cause an incentive stock option to fail to qualify as an “incentive stock option” under Section 422 of the Code.following paragraph:

Administration

“The Plan will be administered by the compensation committee of the Board of Directors. The Company will pay all costs of administering the Plan.

Eligibility

The Plan authorizes the grant to employees of incentive stock options and non-qualified stock options. The administrator determines which of the employees will be granted options. No person is entitled to participate in the Plan as a matter of right. Only those employees who are selected to receive grants by the administrator may participate in the Plan. No person will be granted options to purchase more than 225,000 shares of Common Stock in any calendar year under the Plan. In addition, to the extent that an optionee would have the right in any calendar year to exercise for the first time one or more incentive stock options for shares having an aggregate fair market value (under all of our plans and determined for each share as of the date the option to purchase the share was granted) in excess of $100,000, such excess options shall be treated as non-qualified stock options.

Terms and Vesting of Options

The administrator determines:

The administrator may not grant an incentive stock option under the Plan to any person who owns more than 10% of the total combined voting power of all classes of our stock (a “10% Owner”) unless the stock option conforms to the applicable provisions of Section 422 of the Code. Only employees may be granted incentive stock options under the Plan.

The term of an option is set by the administrator. In the case of an incentive stock option, the term of the option may not be longer than 10 years from the date the incentive stock option is granted, or if granted to a 10% Owner, five years from the date of the grant. Except as limited by the requirements of Section 422 of the Code, the administrator may extend the term of any outstanding option in connection with any termination of employment of an optionee by up to four (4) years, or amend any other term or condition of the outstanding option relating to the termination of an optionee.

An option is exercisable when it “vests.” Each option agreement will contain the period during which the rightcorporation shall be authorized to exercise the option in whole or in part vests in the optionee. At any time after the grant of an option, the administrator may accelerate the period during which an option vests. No portion of an option whichissue is unexercisable at an optionee’s termination of employment will subsequently become exercisable, except as may be otherwise provided by the administrator either in the agreement relating to the stock option or by action following the grant of the option.

18

Exercise Price

The exercise price for the107,500,000 shares, of Common Stock subject to each option will be specified in each option agreement. The administrator sets the exercise price at the time the option is granted. In certain instances, the exercise price is also subject to additional rules as follows:

For purposes of the Plan, the fair market value of a share of our Common Stock as of a given date will be determined by the closing sales price for our Common Stock as quoted on any established stock exchange or market, or in the absence of such markets for our Common Stock, in good faith by our Board of Directors.

Exercisability

The compensation committee determines when options become exercisable, including any restrictions or limitations such as those based on continued employment.

An option may be exercised by delivering to our corporate Secretary a written notice of exercise on a form provided by us, together with full cash payment for the shares in the form of cash or a check payable to us in the amount of the aggregate option exercise price.

Adjustment Upon Changes in Capitalization or Merger

The administrator will appropriately adjust:

if there is any stock dividend, stock split, recapitalization, or other subdivision, combination or reclassificationdivided into three classes of shares of Common Stock.

Changestock as follows: 80,000,000 shares of Control

In the event of

then all outstanding options under the Plan will become fully vested and exercisable immediately prior to the effective date of the change in control.Class A

19

Common Stock, par value $0.0001 per share (“Class A Common”), 20,000,000 shares of Class B Common Stock, par value $0.0001 per share (“Class B Common”), and 7,500,000 shares of Preferred Stock, par value $0.0001 per share (“Preferred Stock”).”

TransferabilityThe text of the proposed certificate of amendment to our existing restated certificate of incorporation is attached asAppendix B to this proxy statement. Copies of our existing restated certificate of incorporation are available for inspection at our principal executive offices and will be sent to any stockholder upon written request. If all of the proposed amendments to our existing restated certificate of incorporation are adopted, the proposed certificate of amendment to our existing restated certificate of incorporation will become effective upon its filing with the Secretary of the State of Delaware.

An optionee cannot assign or transfer any option granted under the Plan, except by will or the laws of descent and distribution or, subject to the consentAdoption of the administrator, pursuantproposed certificate of amendment to a domestic relations order. Each option may be exercised, duringour existing restated certificate of incorporation by our stockholders will not constitute the lifetimeissuance of additional shares of Class A Common Stock, Class B Common Stock or Preferred Stock and will not affect the rights of the optionee, only byholders of currently outstanding shares of such optionee.stock.